IRS 943-X 2012 free printable template

Show details

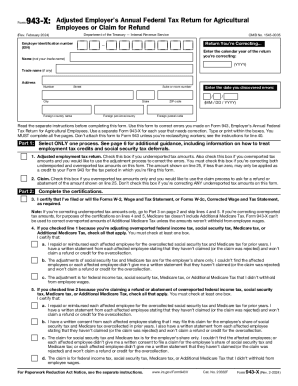

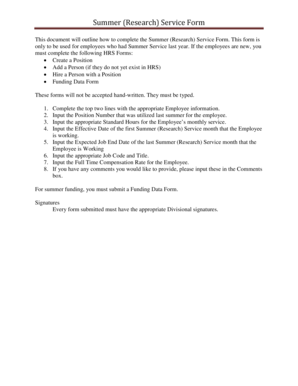

Next For Paperwork Reduction Act Notice see separate instructions. Cat. No. 20332F Form 943-X Rev. 2-2012 Part 3 Enter the corrections for the calendar year you are correcting. Form 943-X Adjusted Employer s Annual Federal Tax Return for Agricultural Employees or Claim for Refund Rev. February 2012 Department of the Treasury Internal Revenue Service Employer identification number EIN OMB No. 1545-0035 Return You Are Correcting. Enter the Calend...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your 943x 2012 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 943x 2012 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 943x online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 943x form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

IRS 943-X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 943x 2012 form

How to fill out 943x:

01

Begin by entering your personal information in the designated fields. This includes your name, address, social security number, and any other requested details.

02

Next, provide information about your income. This may include wages, self-employment earnings, interest, dividends, and any other applicable sources of income.

03

Fill out the necessary sections related to deductions and credits. This may include information on dependents, education expenses, healthcare costs, and other eligible deductions or credits.

04

Double-check all the information you have entered to ensure accuracy. Incorrect or incomplete information may lead to delays or errors in processing your tax return.

05

Sign and date the form, and provide any additional required documentation or attachments as specified by the instructions.

Who needs 943x:

01

Individuals who have received income from self-employment or certain other sources may need to fill out Form 943x. This includes those who pay wages to farmworkers, household employees, or individuals who work in certain fishing operations.

02

It is important to review the instructions for Form 943x or consult with a tax professional to determine if you meet the criteria for needing this form.

03

Employers and businesses must file Form 943x to report taxes withheld from employee wages and to reconcile any discrepancies between the amounts reported and the amounts paid.

Note: Form 943x is a hypothetical form and does not exist in the official tax forms.

Fill form : Try Risk Free

People Also Ask about 943x

Can a company file both a 941 and a 943?

Can you file a 941 and a 943?

How to fill out a 943 form?

Who completes form 943?

What is the deposit requirement for form 943?

Do farmers file 941 or 943?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 943x?

943x is an unknown mathematical expression and cannot be solved without more information.

Who is required to file 943x?

Any business or organization that is required to pay federal taxes withheld from wages of agricultural employees is required to file Form 943x.

How to fill out 943x?

1. Start by entering the employer’s name, address, and phone number at the top of the form.

2. Enter the appropriate tax year and quarter in the boxes provided.

3. Enter the employer’s federal employer identification number (FEIN).

4. Enter the total number of employees paid wages subject to federal income tax withholding during the quarter in the boxes provided.

5. Enter the total amount of wages, tips, and other compensation paid during the quarter in the boxes provided.

6. Enter the total amount of federal income tax withheld from all employees during the quarter in the boxes provided.

7. Enter the total amount of Social Security and Medicare taxes withheld from all employees during the quarter in the boxes provided.

8. Enter the total amount of Social Security and Medicare taxes owed for the quarter in the boxes provided.

9. Sign and date the form.

10. Make a copy of the form for your records.

11. Mail the original form to the IRS address indicated on the form.

What information must be reported on 943x?

The 943x forms are used by employers to report federal income tax, Social Security, and Medicare taxes withheld from their employees. The information that must be reported on 943x forms includes:

1. Employer’s name, address, and employer identification number (EIN).

2. Employee’s name, address, and Social Security number.

3. Amount of wages, tips, and other compensation paid to the employee during the tax year.

4. Federal income tax withheld from the employee’s wages.

5. Social Security and Medicare taxes withheld from the employee’s wages.

6. Any additional taxes or credits.

What is the penalty for the late filing of 943x?

The penalty for the late filing of Form 943x is 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25% of the total unpaid taxes.

When is the deadline to file 943x in 2023?

The deadline to file Form 943-X (Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund) in 2023 would typically be on January 31, 2024. However, tax deadlines can vary, so it is essential to check with the Internal Revenue Service (IRS) or consult a tax professional for precise and up-to-date information.

How can I get 943x?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the 943x form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute form 943 x online?

With pdfFiller, you may easily complete and sign 943 x online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I fill out form 943x on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 943 x form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your 943x 2012 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 943 X is not the form you're looking for?Search for another form here.

Keywords relevant to 943x instructions form

Related to form 943 x instructions

If you believe that this page should be taken down, please follow our DMCA take down process

here

.